Deciphering The Surrey County Tax Map: A Complete Information

Deciphering the Surrey County Tax Map: A Complete Information

Associated Articles: Deciphering the Surrey County Tax Map: A Complete Information

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Deciphering the Surrey County Tax Map: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Deciphering the Surrey County Tax Map: A Complete Information

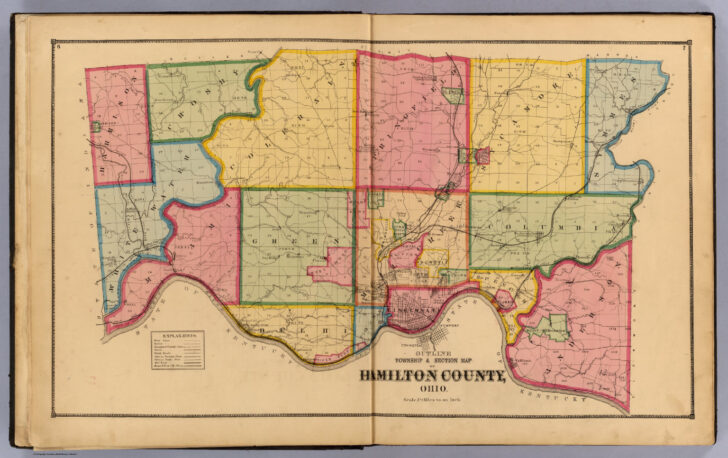

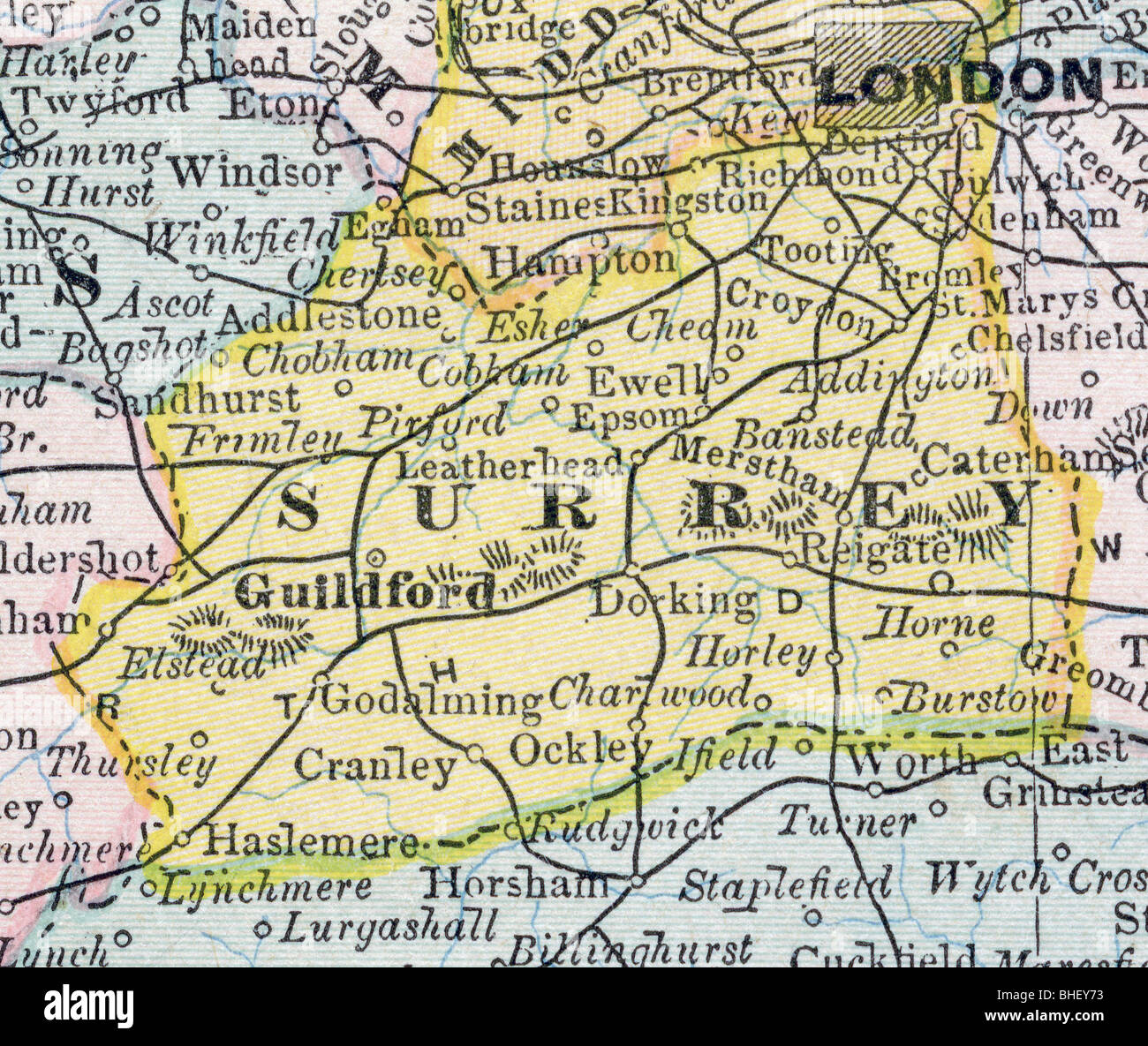

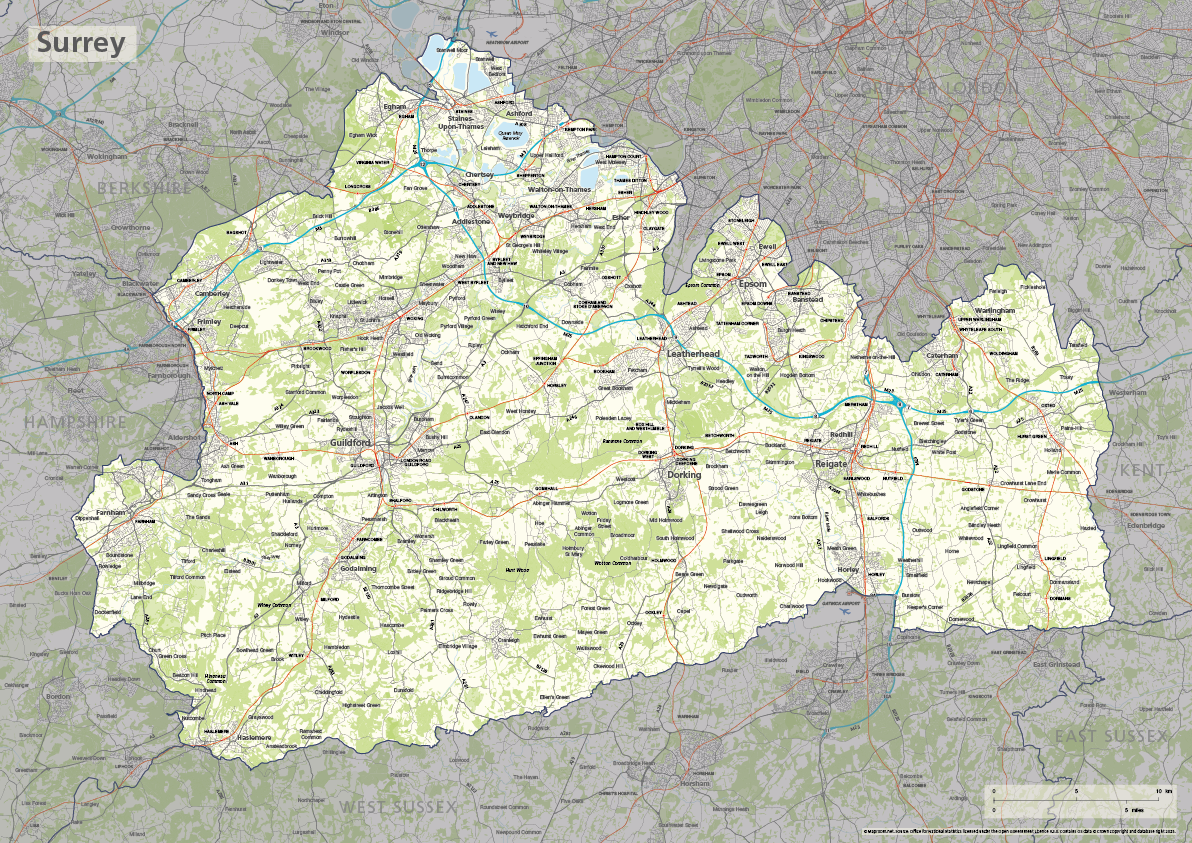

Surrey County, identified for its picturesque landscapes and thriving communities, additionally boasts a posh system of property taxation. Understanding this technique begins with navigating the Surrey County tax map, a vital device for owners, potential consumers, and anybody within the county’s actual property panorama. This text gives a complete information to decoding Surrey County’s tax maps, highlighting their makes use of, limitations, and find out how to entry and make the most of them successfully.

Understanding the Objective of Tax Maps:

Tax maps should not merely visible representations of land; they’re legally binding paperwork that serve a number of important functions:

-

Property Identification: Every parcel of land inside Surrey County is uniquely recognized on the tax map, sometimes with a parcel quantity or ID. This quantity is essential for all property-related transactions, together with tax assessments, deeds, and title searches.

-

Tax Evaluation: The maps present the premise for assessing property taxes. The scale, location, and traits of a property as depicted on the map affect its assessed worth, which straight impacts the quantity of property tax owed.

-

Property Boundaries: Whereas not all the time completely correct all the way down to the inch, tax maps usually present the boundaries of particular person properties. That is particularly essential for resolving boundary disputes or understanding the extent of 1’s possession.

-

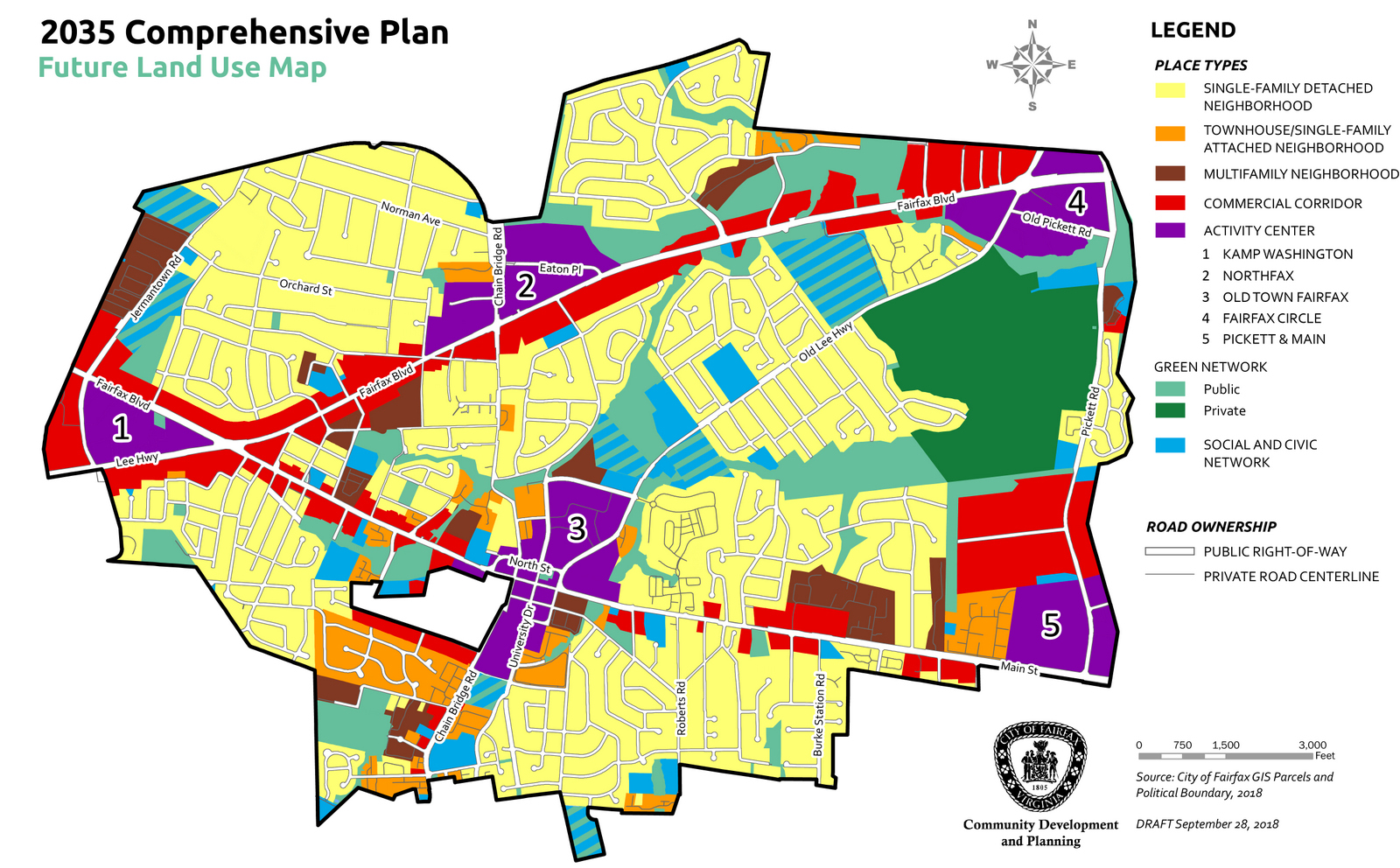

Planning and Improvement: Native governments and builders make the most of tax maps for planning functions, together with zoning, infrastructure improvement, and environmental impression assessments. The maps present a transparent overview of land possession and utilization.

-

Emergency Providers: Throughout emergencies, tax maps will be invaluable for finding particular properties and coordinating rescue efforts. First responders typically depend on these maps for fast and correct navigation.

Accessing Surrey County Tax Maps:

The strategy for accessing Surrey County’s tax maps varies relying on the particular county in query (assuming "Surrey County" refers to a county in a particular state/nation, as there are a number of counties with this identify). Usually, entry is accessible via a number of channels:

-

County Assessor’s Workplace Web site: That is typically the first supply. Most county assessor’s places of work keep on-line databases of tax maps, typically with interactive search capabilities permitting customers to go looking by tackle, parcel quantity, or proprietor’s identify. These web sites ceaselessly supply downloadable map photos in varied codecs (PDF, GIS).

-

County GIS (Geographic Info System) Portal: Many counties make the most of GIS know-how to create extremely detailed and interactive maps. These portals often supply superior search functionalities, permitting customers to layer completely different knowledge units onto the tax map, akin to zoning info, floodplains, and utilities.

-

Third-Celebration Actual Property Web sites: Web sites like Zillow, Realtor.com, and others typically incorporate tax map knowledge into their property listings. Nevertheless, the accuracy and element of those maps could also be restricted in comparison with the official county sources.

-

In-Particular person Go to to the Assessor’s Workplace: For advanced inquiries or if on-line entry is unavailable, a go to to the county assessor’s workplace is an choice. Employees can help with navigating the maps and answering particular questions.

Deciphering Surrey County Tax Maps:

Tax maps are sometimes composed of a number of key parts:

-

Parcel Numbers: These distinctive identifiers are essential for pinpointing particular properties. They’re often prominently displayed on the map.

-

Property Boundaries: Strains delineating the boundaries of particular person properties are proven, typically with notations indicating possession. These boundaries must be verified with official deeds and surveys for full accuracy.

-

Tackle Info: Road addresses are sometimes included, though the extent of element can range.

-

Land Use Codes: Codes may point out the kind of land use (residential, industrial, agricultural, and so forth.).

-

Topographical Options: Some maps incorporate topographical info, akin to elevation contours, water our bodies, and roads.

-

Scale and Legend: A scale signifies the connection between the map’s dimensions and real-world distances. A legend explains the symbols and abbreviations used on the map.

Limitations of Tax Maps:

It is essential to grasp the constraints of tax maps:

-

Accuracy: Whereas tax maps try for accuracy, minor discrepancies can exist as a consequence of surveying errors, modifications in property traces over time, or outdated knowledge. At all times confirm essential info with official information.

-

Scale and Element: The extent of element varies relying on the map’s scale. Smaller-scale maps present a broader overview, whereas larger-scale maps supply extra element however might cowl a smaller space.

-

Knowledge Updates: Tax maps are periodically up to date, however there may be a lag between modifications on the bottom and their reflection on the map.

-

Lacking Info: Tax maps might not all the time include all related info, akin to easements, zoning restrictions, or utility traces. Extra analysis could also be mandatory.

Utilizing Tax Maps Successfully:

To maximise the worth of Surrey County’s tax maps, think about the next:

-

Confirm Info: By no means rely solely on the tax map for vital choices. At all times cross-reference the data with official information, akin to deeds, surveys, and assessor’s information.

-

Perceive the Scale: Pay shut consideration to the map’s scale to precisely interpret distances and property sizes.

-

Use On-line Instruments: Leverage the interactive options of on-line tax map portals to seek for particular properties, overlay completely different knowledge layers, and measure distances.

-

Search Skilled Help: For advanced property points or if you happen to’re not sure about decoding the map, seek the advice of a surveyor, actual property legal professional, or different related skilled.

Conclusion:

Surrey County’s tax maps are important instruments for understanding the county’s property panorama. By understanding their objective, accessing them successfully, and decoding their info appropriately, people and organizations could make knowledgeable choices associated to property possession, taxation, planning, and improvement. Nevertheless, it is essential to keep in mind that tax maps are only one piece of the puzzle, and verifying info with official information is paramount for accuracy and authorized compliance. The knowledge offered on this article serves as a normal information; all the time seek the advice of the particular sources and pointers offered by the related Surrey County Assessor’s workplace for essentially the most up-to-date and correct info.

.png)

Closure

Thus, we hope this text has offered beneficial insights into Deciphering the Surrey County Tax Map: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!